Asset allocation is one of the most critical decisions in investment management, determining the balance between risk and return in your portfolio. Over time, market movements can cause your portfolio’s allocation to drift from its target, leading to increased risk or missed opportunities for growth. Rebalancing is the process of realigning your portfolio to its intended asset allocation, ensuring it continues to meet your financial goals. Here’s how asset allocation plays a pivotal role in rebalancing.

What is Asset Allocation?

Asset allocation involves dividing your investment portfolio among different asset classes, such as stocks, bonds, real estate, and cash. The goal is to create a diversified portfolio that aligns with your risk tolerance, time horizon, and financial objectives.

Common Asset Classes:

• Stocks: Offer potential for high returns but come with higher risk.

• Bonds: Provide more stable returns with lower risk, often used to balance the volatility of stocks.

• Real Estate: Can offer income and capital appreciation, often less correlated with stocks and bonds.

• Cash: Provides liquidity and stability but typically yields lower returns.

The right mix of these assets depends on your individual financial situation, including how much risk you’re willing to take and how long you plan to invest.

Why Asset Allocation Matters in Rebalancing

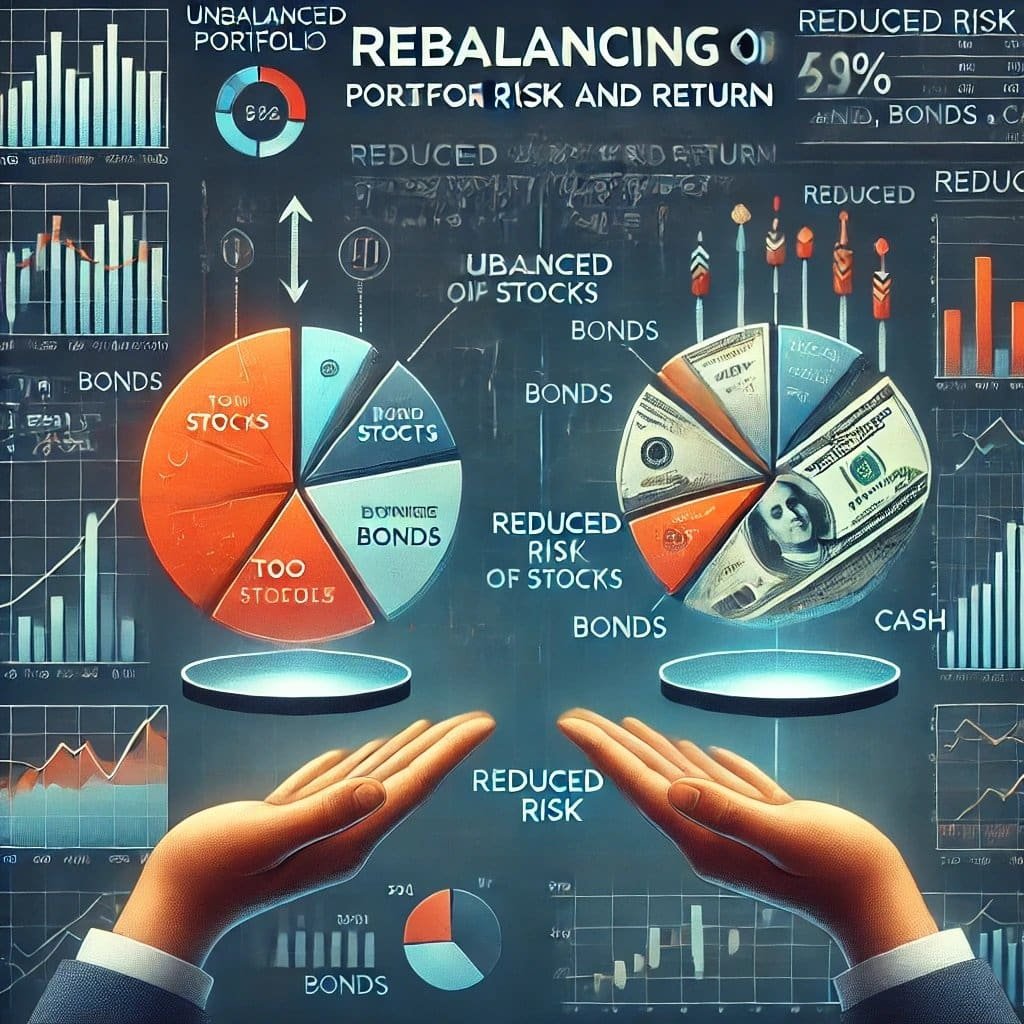

1. Maintaining Risk Levels

Your asset allocation is designed to match your risk tolerance. Over time, some assets may outperform others, causing your portfolio to become more heavily weighted in higher-risk investments, such as stocks. This drift can expose you to more risk than you originally intended.

Example: If your target allocation is 60% stocks and 40% bonds, but stocks perform well and shift your allocation to 75% stocks and 25% bonds, your portfolio now carries more risk. Rebalancing brings it back to the original 60/40 split, realigning it with your risk tolerance.

2. Optimizing Returns

A well-diversified portfolio aims to optimize returns for a given level of risk. When one asset class outperforms, rebalancing ensures you capture gains while maintaining your portfolio’s intended risk profile.

Example: Rebalancing might involve selling some of the appreciated stocks and buying more bonds or other underperforming assets. This “buy low, sell high” approach can enhance long-term returns.

3. Avoiding Emotional Decision-Making

Without a disciplined rebalancing strategy, investors may be tempted to chase performance by holding onto winning assets and selling underperformers. This behavior can lead to buying high and selling low, eroding returns over time.

Example: During a bull market, you might be tempted to let your stock allocation grow unchecked. Rebalancing enforces discipline by prompting you to sell some of the high-performing assets and reinvest in others, helping you stick to your strategy.

How to Rebalance Based on Asset Allocation

1. Set Your Target Allocation

Your target allocation should reflect your risk tolerance, financial goals, and investment horizon. A common starting point might be 60% stocks and 40% bonds for a moderate risk tolerance, but this varies based on individual circumstances.

2. Monitor Your Portfolio

Regularly review your portfolio to ensure it stays close to your target allocation. Significant market movements can quickly shift your allocation, necessitating a review and potential rebalancing.

Example: Check your portfolio quarterly or annually to see if any asset class has deviated from your target by a set threshold, such as 5%.

3. Choose a Rebalancing Strategy

• Time-Based Rebalancing: Rebalance your portfolio at regular intervals, such as annually, regardless of how much the allocation has drifted.

• Threshold-Based Rebalancing: Rebalance only when an asset class deviates from your target allocation by a certain percentage (e.g., 5% or more).

4. Implement the Rebalance

To bring your portfolio back to its target allocation, you may need to sell overperforming assets and buy underperforming ones. Consider transaction costs, taxes, and any other potential implications before making trades.

5. Consider Tax-Efficiency

When rebalancing in taxable accounts, be mindful of capital gains taxes. You can reduce tax impact by rebalancing within tax-advantaged accounts (like IRAs), using tax-loss harvesting, or directing new contributions to underweighted asset classes.

Conclusion

Asset allocation is the foundation of your investment strategy, and rebalancing is the process that keeps your portfolio aligned with your financial goals. By maintaining your target allocation, you can manage risk, optimize returns, and avoid the pitfalls of emotional decision-making. Whether you choose to rebalance based on time intervals or when your allocation drifts beyond a set threshold, a disciplined approach will help ensure your portfolio continues to serve your long-term objectives.

8 comments